what is the salt deduction repeal

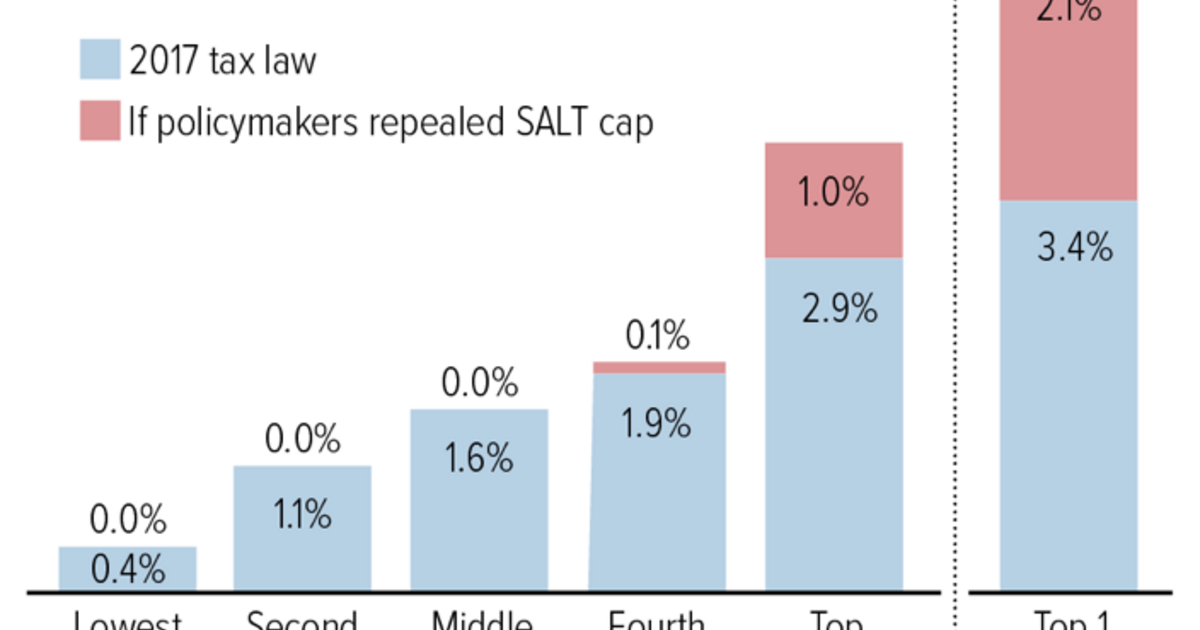

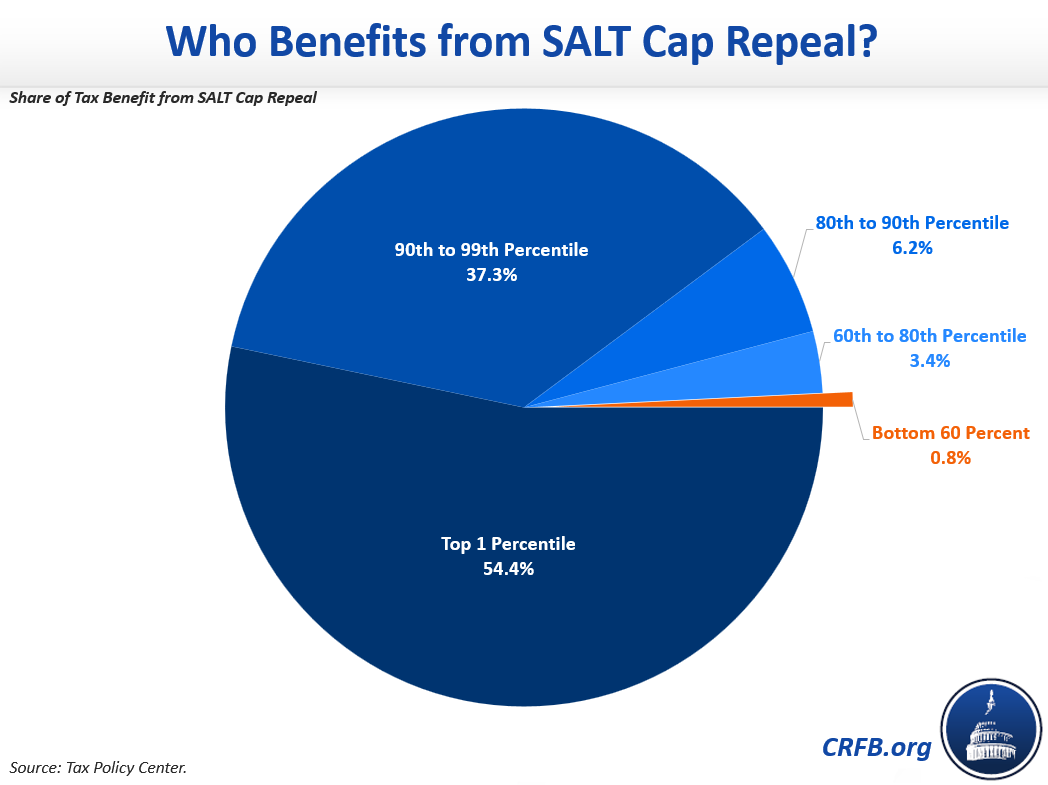

The SALT deduction when no cap is in place is a highly regressive tax policy meaning its benefits go to the wealthiest taxpayers who regularly write off over 10000 on their taxes. A new bill seeks to repeal the 10000 cap on state and local tax.

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

What is the salt deduction repeal.

. It allows those with the most expensive mortgages and by extension the highest incomes to deduct the most reducing their federal taxes by much more than those of the average. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns.

The SALT deduction limitation or cap has had the greatest impact on those taxpayers owning high-value real property residing in high-tax jurisdictions or earning high incomes generally. The change may be significant for filers who itemize deductions in high-tax states and. This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and Jobs Act of 2017.

A group of moderate lawmakers are pushing to repeal the so-called SALT deduction cap in the reconciliation package saying no SALT no deal but other Democrats are trying to slam the brakes on. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

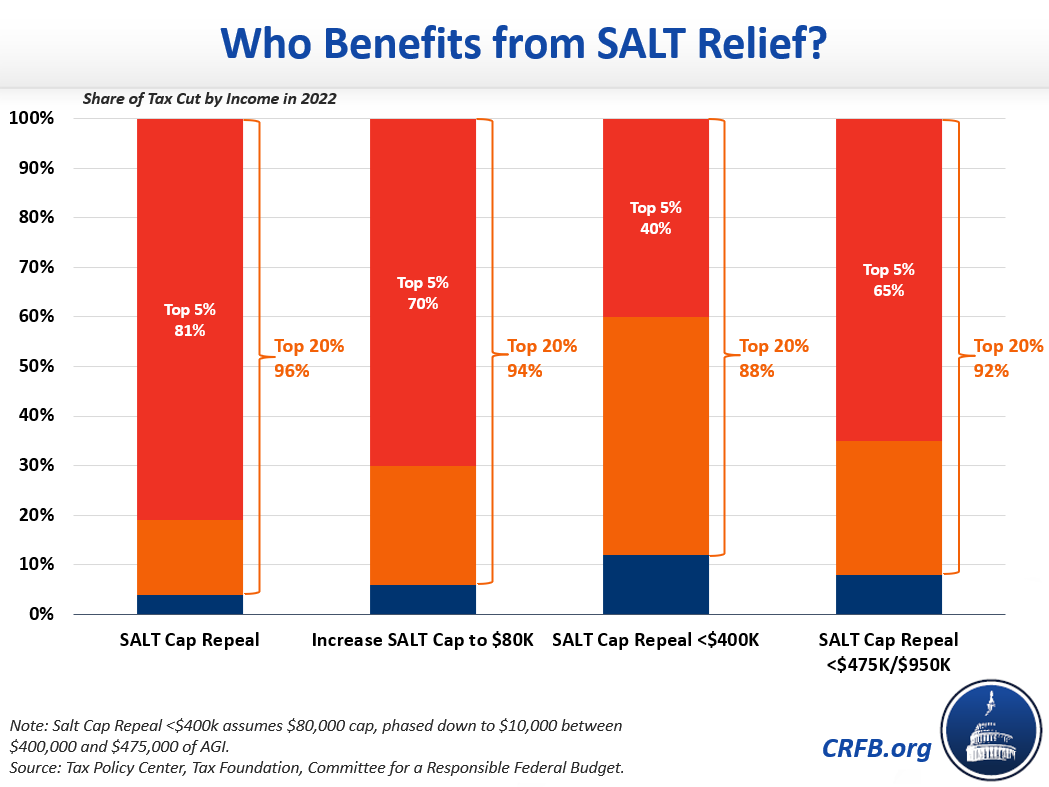

Though this increase in the SALT deduction cap would be less costly than full repeal it would still cost more than almost any other part of Build Back Better with just the child care subsidies. Almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile giving an average tax cut. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

The federal tax reform law passed on Dec. A growing rift among Democrats over whether to repeal a Trump-era limit on state and local tax deductions is threatening to derail President Biden s. Though there is a controversy behind this change as the average SALT tax paid isnt even one-tenth.

The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. 54 rows Some lawmakers have expressed interest in repealing the SALT cap which was originally imposed as. Americans who rely on the state and local tax SALT deduction at.

11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for state. To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households making below 900000 or 950000 per year. The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

A bill from House Ways and Means Chairman Richard Neal and others would modify and then repeal for two years the 2017 tax laws cap on the federal deduction for state and local taxes SALT and offset the cost over ten years by. Preserving the deduction cap or better yet a full repeal of the SALT deduction would result in wealthy residents feeling the full effect of the policies passed by their state and local governments. As Democrats debate Build Back Better the plan may still include changes to the 10000 limit on the federal deduction for state and local taxes known as SALT despite reports the.

Starting with the 2018 tax year the maximum SALT deduction available was 10000. New limits for SALT tax write off. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly.

The rich especially the very rich. Biden Officials Push For Progress On Infrastructure Plan By Memorial Day Youtube In 2021 Memorial Day Memories Infrastructure Bullish Streaks The Stock Market Was Down Slightly On Thursday But The Amazing Year For Stocks Continues The Chart Below Shows Stock Market Chart Income Tax. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

The SALT deduction allows states and localities to give their high income earners a discount on their taxes. What is the salt deduction repeal Friday June 3 2022 Edit. SALT Cap Repeal Below 500k Still Costly and Regressive Nov 19 2021 Taxes According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less.

This Bill Could Give You a 60000 Tax Deduction. 52 rows The state and local tax deduction commonly called the SALT deduction is a federal. Monday May 23 2022.

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Salt Deduction Salt Deduction Taxedu

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Deduction Resources Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It